Should You Outsource Medical Billing of Your Independent Practice?

If you own an independent medical practice, you’ve likely wondered whether you should keep your billing processes in house or outsource it to a third party. Different practices will have different preferences based on their size, daily patient volume, number of staff, available budget etc.

For a medical practice, billing and revenue cycle management are critical to ensuring business sustainability.

As your whole cash flow depends on efficient billing, it’s vital to manage it properly. You must assess your operational costs, patient volume and staffing to determine the correct billing model for your practice.

In this article, we’ll break down the components of in-house and outsourced billing, looking at both costs and qualitative factors. We’ll use examples to help you decide, and we’ll also cover the pros and cons of both types of billing.

Cost Analysis of In-House vs. Outsourced Billing

For most small and independent medical practices, the decision to outsource billing or not boils down to one single factor—cost.

To help you compare the costs of in-house and outsourced billing, here’s a hypothetical cost analysis for a medical practice called General Physicians Practice. Here are the main characteristics of this practice:

Four primary care physicians

Two medical billing specialists

$2,500,000 of billed claims per year

Now, how much do both medical billing approaches cost? Let’s take a look at their annual expenses:

Annual costs/collections | In-house billing | Outsourced billing |

Billing department costs Software and hardware costs Direct claim processing costs | $120,000 $8,000 $4,500 | $5,000 $500 $150,000 |

Percent of claims collected Collections Collection Costs | 60 percent $1,500,000 $132,500 | 70 percent $1,750,000 $155,500 |

Collections, net of costs | $1,367,500 | $1,594,500 |

Here is some background on the cost assumptions.

Billing department/staff costs:

In-house: This cost is calculated by adding the median salaries of two medical billing staff members with their health care costs, federal and state taxes, training costs and other ancillary costs such as office space, statement paper and office stationery.

Outsourced: In this model, a staff member has to follow up/communicate with the third-party billing company and undertake administrative tasks of managing all the information. They would be required to devote at least 52 hours per year of their office time for such activities.

Software and hardware costs:

In-house: This cost would normally include the annual costs for practice management software (about $200 per physician per month, totaling $7,200) and another $800 for computer hardware costs.

Outsourced: This cost reflects the cost of operating the computer and printer (say, $500 per year) that the independent practice would have to bear to keep communicating with the third-party billing service or print important documents.

Direct claim processing costs:

In-house: This cost covers the clearing house fees for doing billing in-house, which is approximately $375 per month (for four physicians) or $4,500 per year.

Outsourced: Third-party medical billing service providers usually charge a percentage of the collected claims amount as their fees. The industry average is seven percent.

Percentage of claims (billing amount) collected:

In-house: Though the percentage of revenue collected by a practice varies significantly based on its specialty, on average, a practice collects 60 percent of what it actually bills.

Outsourced: In this model, on average, a practice collects 70 percent of what it actually bills. However, many medical billing service providers could increase the collection rates even further.

Collections:

In-house: Sixty percent of the total collections of $2,500,000, which is $1,500,000.

Outsourced: Seventy percent of the total collections of $2,500,000, which is $1,750,000.

Collection costs:

In-house and outsourced: These are total costs associated with billing, software and hardware as well as direct claim processing.

Collections, net of costs:

In-house and outsourced: “Collections” minus “Collection Costs” are the net collections.

As seen in this hypothetical cost analysis, net collections in the outsourced billing model are more than that in the in-house one. This is primarily based on a billing service provider’s ability to collect a higher percentage (70 percent) of the billed amount.

Therefore, the outsourcing model makes more sense only if the billing service provider improves collections significantly (by about 10 percent more).

However, just doing cost analysis isn’t sufficient. Besides costs, there are several other factors (such as in-house technology issues, staff attrition or lack of expertise) that an independent practice must consider while making the final decision.

Now, let’s look into both processes, their pros and the cons to better understand the approaches.

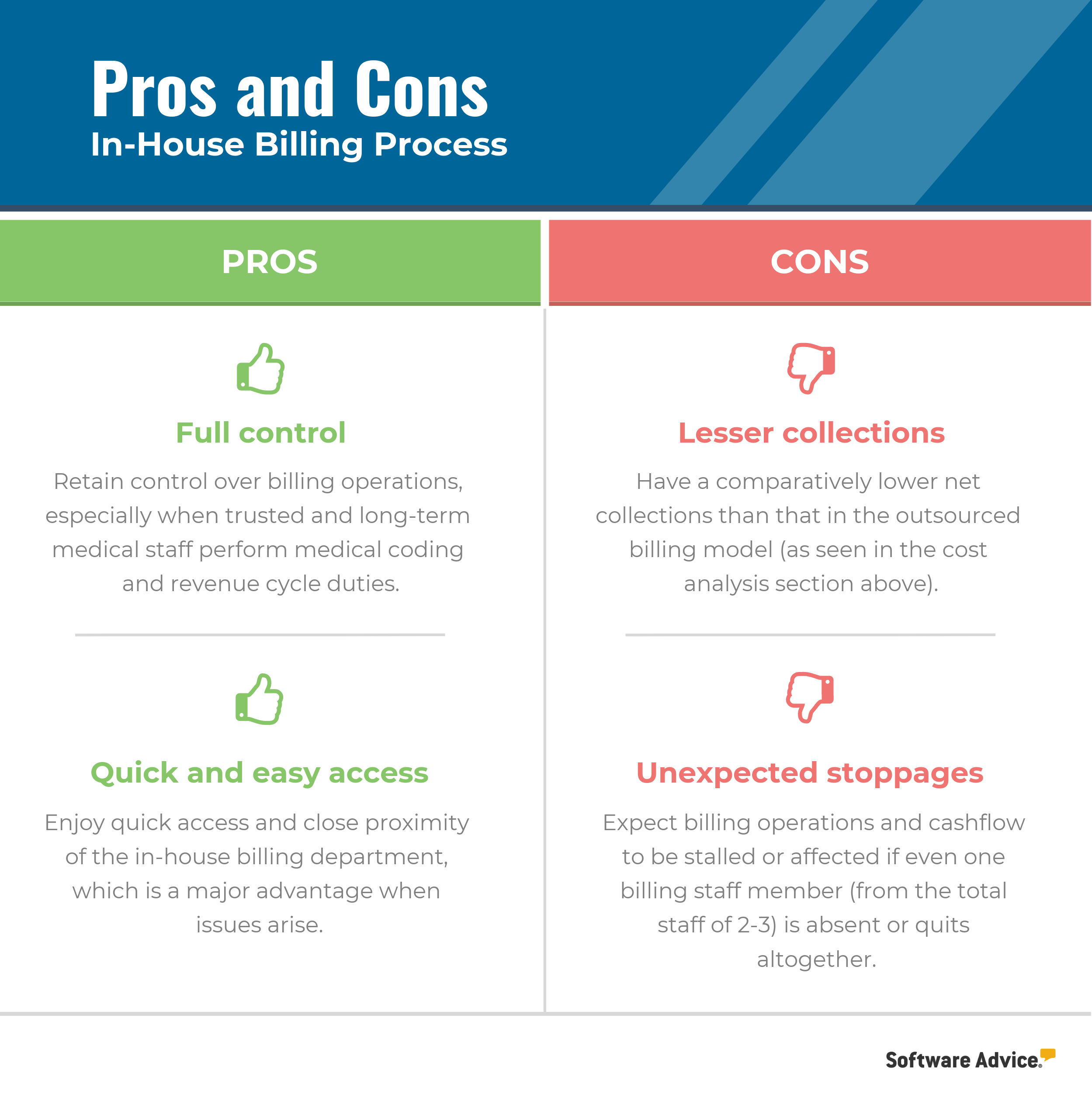

In-House Billing Process: Pros and Cons

The in-house billing procedure for processing insurance claims involves many steps that are universal to every practice.

First, the medical staff enters information into the medical billing software from a superbill that’s prepared during a patient’s visit. The superbill contains specific diagnosis and treatment codes, along with additional patient information that the insurance company needs to verify claims.

Using the software, the practice submits the claim to a medical billing clearinghouse, which verifies the claim and sends it to the payer. The clearinghouse scrubs the claim to check for and rectify errors (for a fee) before sending it to the payer. By not submitting claims directly to a payer, the practice saves time and money and lowers its claim rejection rate.

Once the claim is accepted/rejected by the payer, a notification of the claim status is sent to the clearinghouse, which informs the medical practice about the status of a claim. If a claim is rejected, the practice’s staff gather additional information to resubmit it. The medical practice will be charged for every claim submission, even if it’s a correction.

Let’s look at the pros and cons of in-house billing:

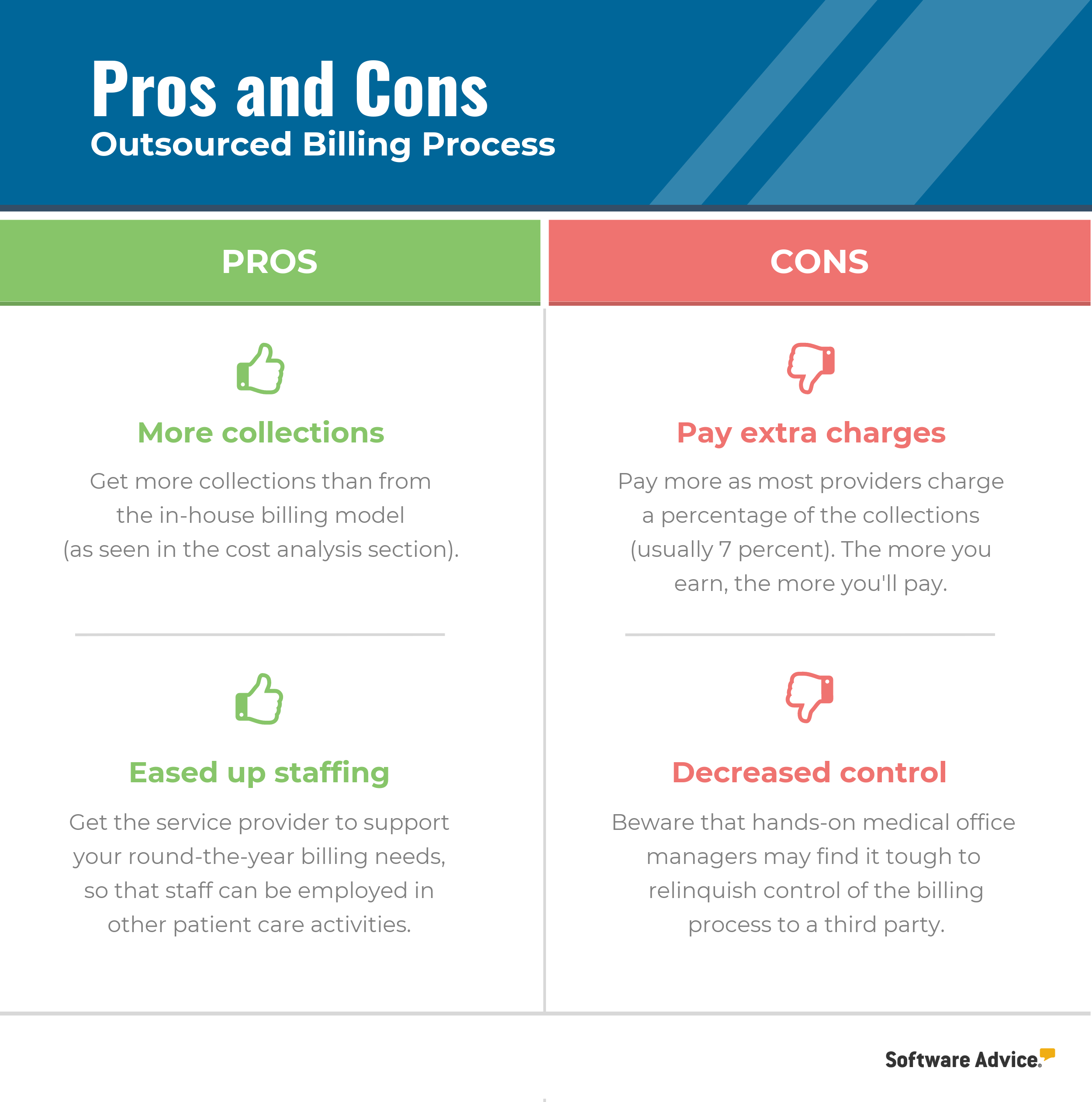

Outsourced Billing Process: Pros and Cons

This process is more straightforward than in-house billing for medical practice staff. They can scan and email superbills and other related documents to the medical billing service provider.

Most medical billing service providers charge a specific percentage of the collected claim amount, with the industry average being approximately 7 percent for processing claims.

The convenience factor is a major reason that medical practices choose to outsource their billing. A provider handles all the data entries and claim submissions on behalf of the medical practice. They also follow up on rejected claims and even send invoices directly to patients.

If a medical practice is using electronic health records (EHR) software, then this process becomes even easier. Practices can store information from a patient’s superbill in the EHR and securely transfer data to the billing service provider using the interoperability feature. This eliminates the need to manually scan and send documents.

Let’s look at the pros and cons of outsourced billing:

Should You Outsource Medical Billing?

Now that you have a detailed view into the billing types, let’s discuss other factors that would influence independent practices like yours to consider outsourcing their billing. Here are some questions you should ask to assess your needs:

Is your billing process inefficient? If your collections are dropping every day, your in-house billing department may be having issues. Outsourcing to a third-party provider could significantly reduce the number of rejected claims and the time taken to receive payments.

Do you have high staff turnover? Staff turnover in a small or independent medical practice, especially in the billing department, can be damaging. Claims processing is the lifeblood of a medical practice. Any additions or replacements in the billing team will inevitably slow down claims processing.

Are you tech savvy? Keeping your billing in house will require investing in practice management software. You’ll also need to frequently train your staff, which adds to the costs. If you don’t want to deal with software upgrades and frequent technical issues, outsourcing your billing is probably the right move.

Are you a new medical practice? New medical practices have their hands full managing patient care, making it tough to manage billing as well. Outsourcing your billing right in the beginning can give you the much needed relief from the day-to-day stress of launching and managing a new practice.

Do you have different priorities? Many solo physicians and small medical practices aren’t too savvy with the business side of things. Some just want to help patients and not undertake administrative tasks. Outsourcing the billing process eliminates this daily hassle and allows you to focus on providing patient care.

Note that outsourcing your billing process to a third-party medical billing service provider isn’t a silver bullet for your in-house billing issues. The efficiency and accuracy of these providers can vary. Therefore, conduct background checks and consult other medical practices of the same size before selecting a provider.

Which Approach Should I Choose?

It’s important for an independent practice to consider their budget and preferences when deciding whether or not to outsource their medical billing process. In a hypothetical scenario, we found that the outsourcing model had higher net collections than an in-house model.

However, cost should not be the only parameter for medical practices to consider whether or not to outsource. There are various other factors in this critical business decision that may be more important than costs for some practices.

For any questions related to different medical software, such as EHR, practice management or billing software, call us at (844) 686-5616 for a free consultation with a medical software advisor.